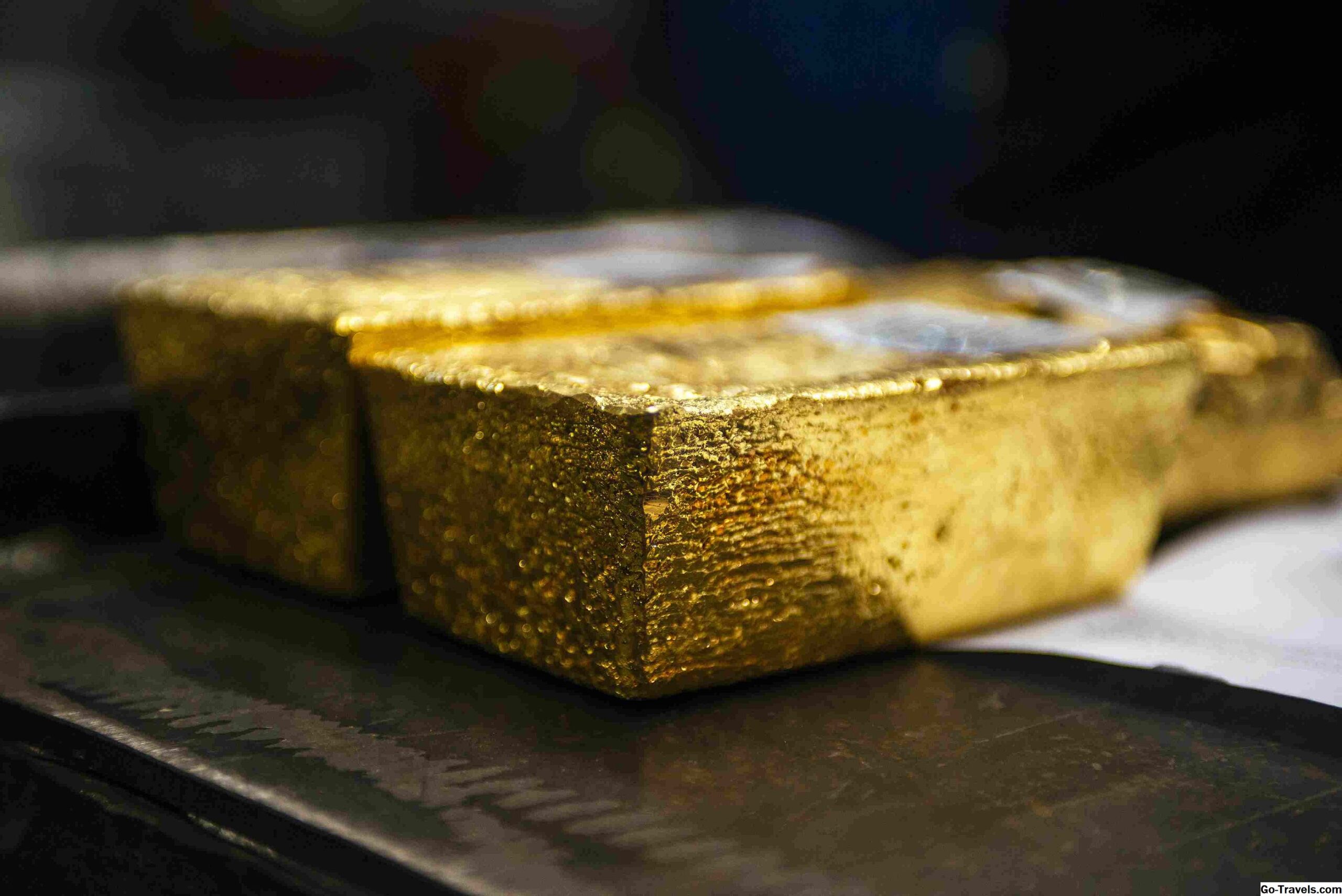

Are you keeping a watch on the great steel? Gold, the timeless picture of wealth and balance, has in recent times made headlines by reaching exceptional heights. With geopolitical tensions on the upward thrust and traders eagerly waiting for financial indicators, the price of gold has soared to new records, surpassing even the most fantastic forecasts.

What’s Driving the Gold Frenzy?

Robust looking for momentum and escalating geopolitical risks have propelled gold to its historic highs. Investors are carefully tracking the discharge of the Federal Reserve’s insurance assembly mins and U.S. Inflation facts, seeking out insights into the future trajectory of hobby costs and the financial device.

We suggest that technical shopping for momentum will retain to stress gold costs besides there is a huge deviation within the Consumer Price Index (CPI) records. A softer inflation record may additionally need to provide similar gasoline for the gold rally, doubtlessly pushing fees in the course of the $2400 mark

Factors Fueling the Rally

Several elements have contributed to the continuing surge in gold expenses. Heightened geopolitical tensions, constant vast financial institution purchases, and resilient call for for jewelry, bars, and coins have all played a characteristic in raising up the fee of the precious metallic.

Our Opinion

The rapid upward push in gold costs may be attributed to a mixture of things, in conjunction with U.S. Hobby costs, inflation dynamics, and geopolitical tensions. Central banks, especially China, have also achieved a widespread role in boosting gold charges with the aid of growing their gold reserves.

Looking Ahead

While the contemporary rally in gold expenses is mind-blowing, some analysts caution that a bearish reversal may be at the horizon. Despite this, many preserve an optimistic outlook for gold, citing its ancient position as a stable haven asset and its resilience in the face of economic uncertainty.

What Does This Mean for Investors?

For consumers, the surge in gold expenses offers every possibilities and demanding situation. While better expenses may additionally increase returns for those already invested in gold, they will also deter new buyers from stepping into the market. Additionally, fluctuations in gold prices can impact the broader economic landscape, influencing the entirety of foreign money values to interest fees.

Conclusion

In the end, the modern-day surge in gold prices has captured the eye of shoppers across the area. With geopolitical tensions on the upward thrust and economic uncertainty looming, gold continues to shine as a secure haven asset. Whether the rally will hold or if a correction is on the horizon remains to be seen, but one thing is for sure: gold will stay a key participant in the global economy.

Read More – Gold Prices: Riding the Wave of Optimism Despite Economic Uncertainty