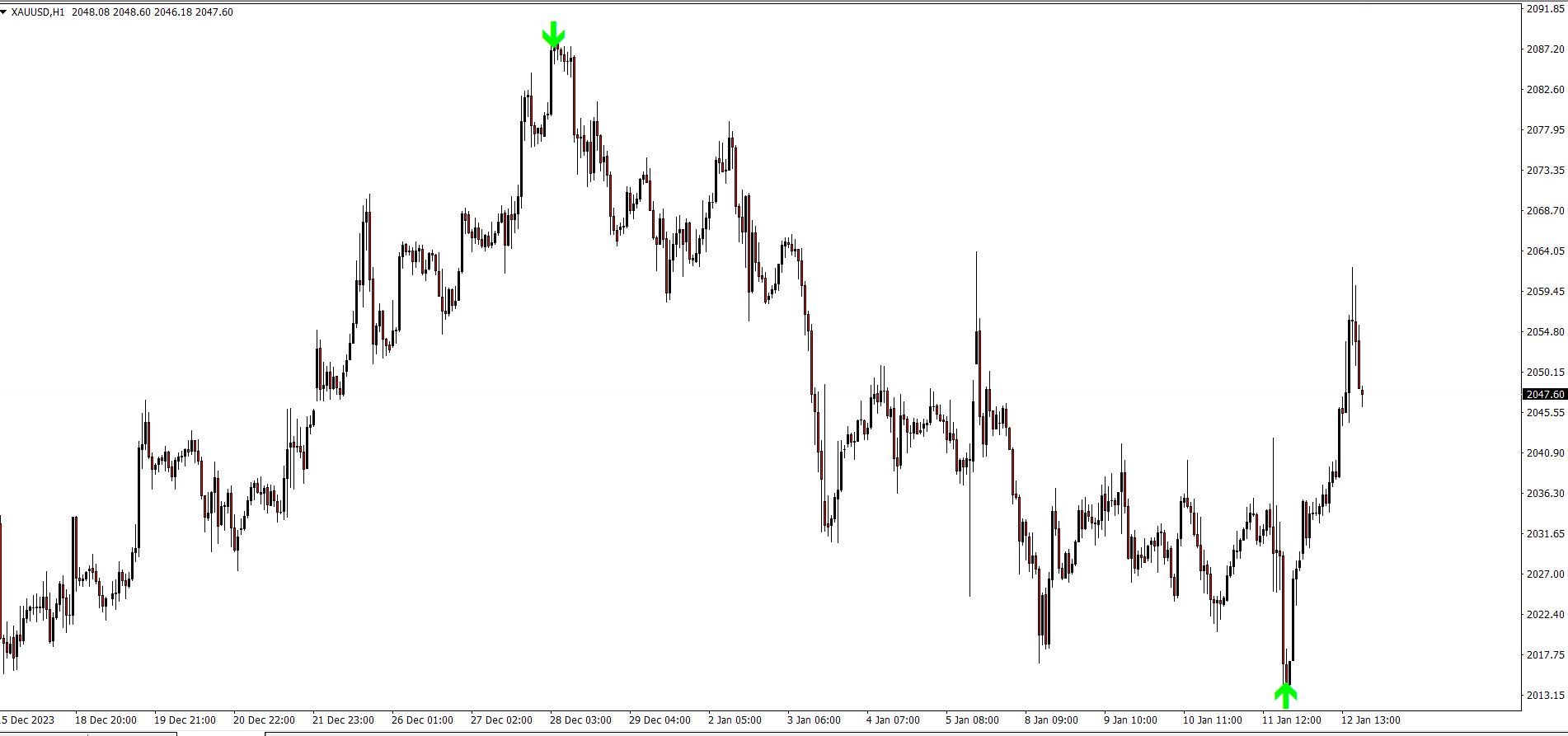

Gold takes the spotlight, dazzling with a 1.2% surge, soaring to a one-week high at $2,052.41. What’s the buzz? Well, buckle up as we unfold the story where global tensions and economic cues collide, making gold the go-to haven for investors.

The Golden Boost Amidst Middle East Stir

Picture this – the Middle East in turmoil as the United States and Britain stir the pot with airstrikes on Houthi sites in Yemen. The result? A seismic shift in global uncertainty, and in this chaos, gold emerges as the steady anchor, drawing investors seeking safety.

Breaking Down the Gold Surge: $2,052.41 in the Spotlight

-

Gold Price Surge: A robust 1.2% surge propels gold to a proud stance at $2,052.41 per ounce, maintaining its throne above the $2,000 mark for nearly a month. U.S. gold futures echo the ascent, rising by 1.9% to $2,057.20.

-

Geopolitical Tensions: The Middle East takes the lead in pushing gold prices higher, especially with the airstrikes in Yemen. The article emphasizes that the surge in gold is powered by the rising geopolitical risks.

-

Expectations of Rate Cuts: Hold your breath – softer U.S. PPI data in December sets the stage for expectations of an earlier Federal Reserve interest rate cut. Traders now buzz with an 80% probability of a rate cut in March, up from the pre-PPI report’s 70%.

-

Inflation and PPI Data: While U.S. consumer prices may have climbed unexpectedly, the PPI’s unexpected fall, the wholesale price gauge, signals positive inflation vibes. The article underscores the PPI’s role as a precursor to inflation trends.

-

Fed’s Monetary Policy: The Federal Reserve whispers of a more flexible monetary policy, and gold appears to be nodding in approval. The article hints at the Fed easing its restrictive approach, creating a favorable climate for gold.

-

Market Sentiment: Despite the sunny U.S. labor market, investors are drawn to gold’s allure. Why? The promise of rate cuts proves irresistible. The article delves into the market’s balancing act between surging U.S. inflation and the optimistic anticipation of imminent rate cuts.

-

Gold’s Safe-Haven Status: Gold steps into its superhero role, gaining strength during uncertain times. The Middle East drama is just another chapter where gold shines as the ultimate safe-haven asset.

-

Physical Demand: It’s not all digital buzz – physical demand for gold is on the rise, particularly in key Asian hubs. With the Chinese New Year around the corner, gold takes the center stage, adding a touch of real-world appeal to its digital glam.

The Unraveling Finale: Gold’s Surging Future

In a nutshell, the surge in gold prices is a harmonious blend of Middle East tensions, unexpected PPI dips, and murmurs of a Federal Reserve policy shift. The magnetic pull of a safe haven, coupled with the anticipation of interest rate cuts, shapes the golden path ahead.

Read More – Gold Prices: Riding the Wave of Optimism Despite Economic Uncertainty