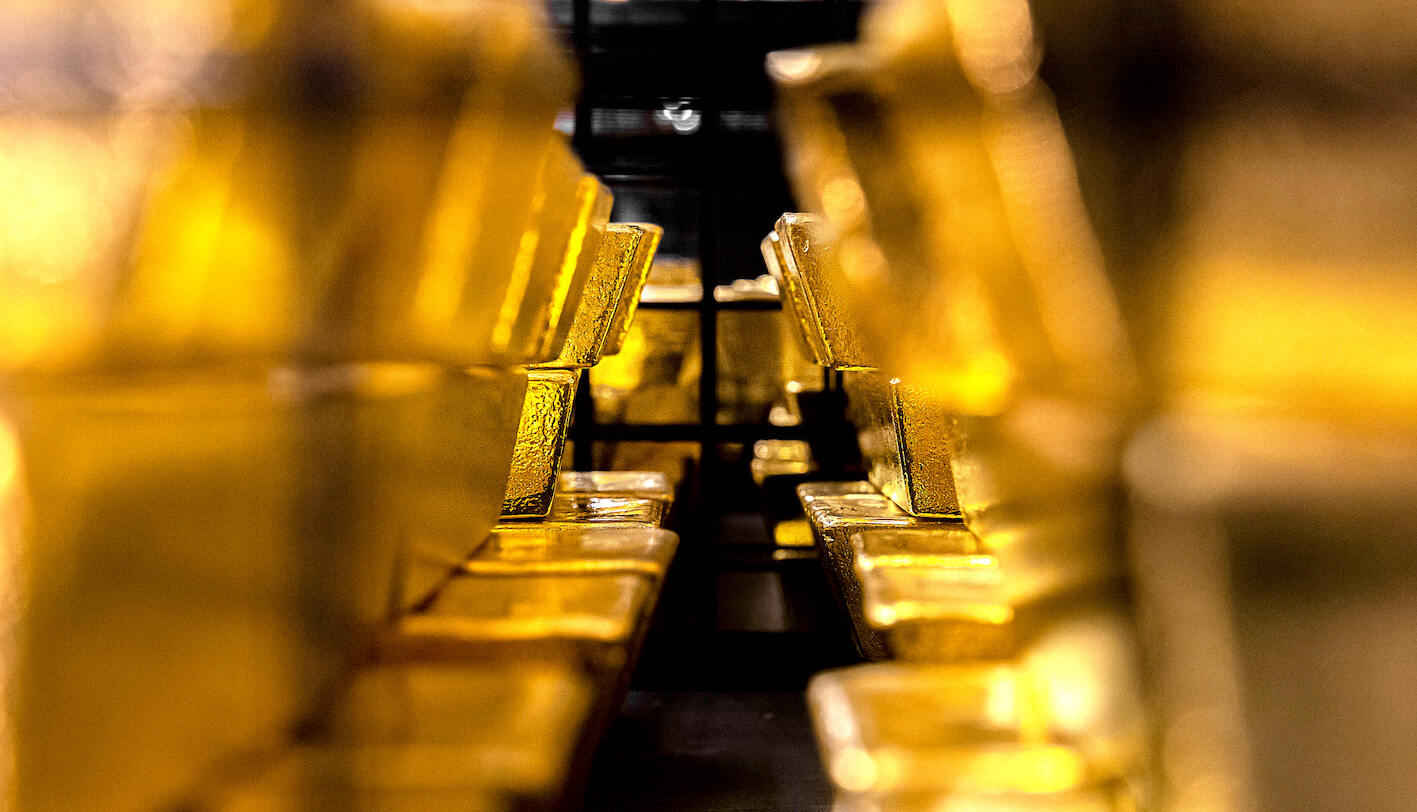

Gold costs noticed a boost on Thursday following the discharge of softer-than-predicted U.S. Manufacturer fees facts, reigniting hopes for capability U.S. Price cuts this 12 months. Additionally, ongoing geopolitical issues persisted to add to the attraction of the precious metallic.

Market Response

Spot gold witnessed a 0.6% boom, attaining $2,346.23, even as U.S. Gold futures also rose through 0.6%, hitting $2,362.20. The favorable records on manufacturer costs contributed to this tremendous motion in gold expenses.

Impact of Producer Prices

According to a file from the Labor Department, the Producer Price Index (PPI) for March confirmed a 0.2% growth month-on-month, which was lower than the 0.3% growth expected by means of economists. This sudden softness in manufacturer costs strengthened expectancies for capability price cuts by way of the Federal Reserve later in the 12 months.

Market Sentiment

Investors reacted positively to the prospect of U.S. Charge cuts, as evidenced by the aid of the uptick in gold fees. The Federal Reserve can also not forget to adjust hobby charges as early as its overdue July assembly, in particular in light of the current inflation facts.

Challenges for Gold

Despite the favorable situations for gold within the short period, higher interest costs could pose challenges for the precious steel. Traditionally considered an inflation hedge, gold can also lose some of its attraction if interest quotes an upward push, as it turns into much less attractive as compared to hobby-bearing assets.

Geopolitical Factors

In addition to the financial indicators, ongoing geopolitical tensions contributed to the shine of gold. Uncertainties surrounding global conflicts, along with the Israel-Hamas war in Gaza, have improved the call for for secure-haven property like gold.

Outlook

The outlook for gold prices remains uncertain, as it depends on different factors, consisting of hobby price decisions by means of the Federal Reserve and geopolitical developments. While the current uptick in costs is encouraging for gold Investors, the lengthy-term trajectory will be inspired by using broader monetary tendencies.

Conclusion

The rise in gold costs following the discharge of softer U.S. Manufacturer charges information underscores the complicated interaction between monetary signs and market sentiment. As investors weigh the capacity for U.S. Charge cuts in opposition to geopolitical uncertainties, gold continues to keep its appeal as a secure-haven asset.

Read More – Gold Prices: Riding the Wave of Optimism Despite Economic Uncertainty