When it comes to gold, the smart money from big bank commercial traders has a different take on the short to medium-term outlook. Amid the excitement of gold fever, let’s delve into their insights and unravel the complex dynamics shaping the world’s most coveted metal.

The Commercial Traders’ Perspective

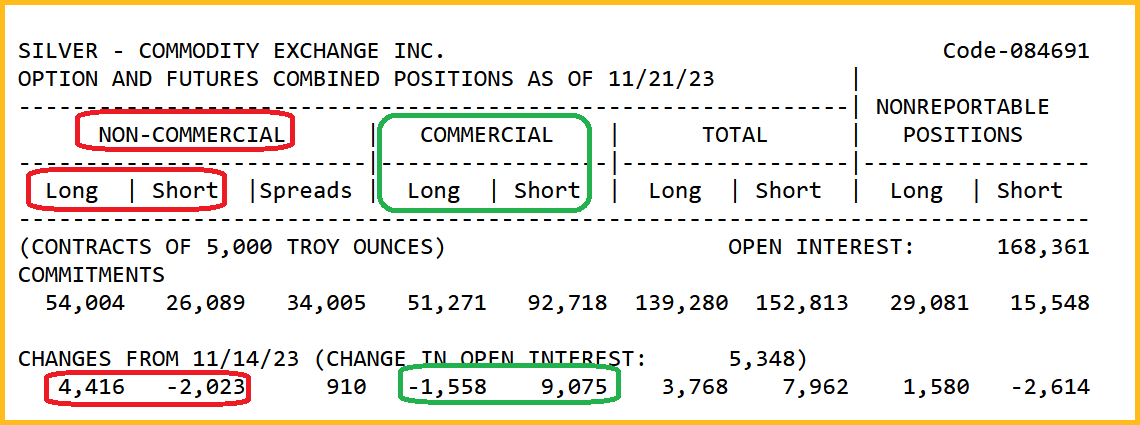

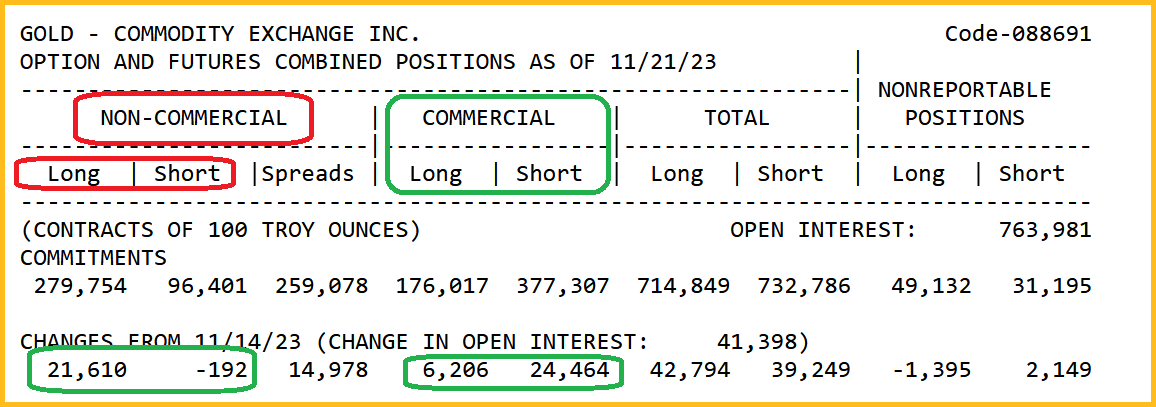

While big bank analysts share a positive long-term outlook for gold, commercial traders are taking a different stance in the short to medium-term. Their strategic moves, especially shorting gold and silver markets during the rally, raise questions about the immediate future of gold prices.

Long-Term Gold Fever

The economic ascent of gold-oriented citizens in China and India fuels a relentless rise in gold, projecting a positive outlook for the next 100 to 200 years. The long-term perspective aligns with the continuous growth of gold demand from these powerhouse nations.

Commercial Traders’ Strategy

Commercial traders are known for their contrarian approach. While amateurs base their buying decisions on price projections, professionals focus on significant price weakness. The aggressive shorting into the rally suggests that commercial traders anticipate a potential decline in gold prices.

Timing the Market

Amateur gold bugs may occasionally hit the mark, but commercial traders consistently spot price declines shortly after executing their sell programs. Conversely, their buy programs, such as the recent one at $1825, often precede substantial price appreciation.

Strategic Entry Point at $1925

For gold enthusiasts eyeing new buys, the number to watch is $1925. Commercial traders would likely be buyers at this level, indicating a potential sweet spot for entry. As gold rallies towards the $2080 highs, the focus remains on strategic entry points and a hope for a significant dip in the price.

Technical Analysis: Inverse H&S Pattern

The daily gold chart reveals an intriguing inverse head and shoulders (H&S) pattern, signaling potential upward movement. This pattern aligns with predictions from prominent Indian jewelers, foreseeing a target of $2200 by January or February. The likelihood of reaching $2080 in the near future appears strong.

Gold’s Rollercoaster: The Journey Ahead:

As gold enthusiasts track the market’s twists and turns, the journey ahead holds anticipation. The $1925 entry point becomes a focal number, while the aspiration for gold to reach $2080 adds to the excitement. Navigating the inverse H&S pattern adds a layer of complexity to the gold rollercoaster.