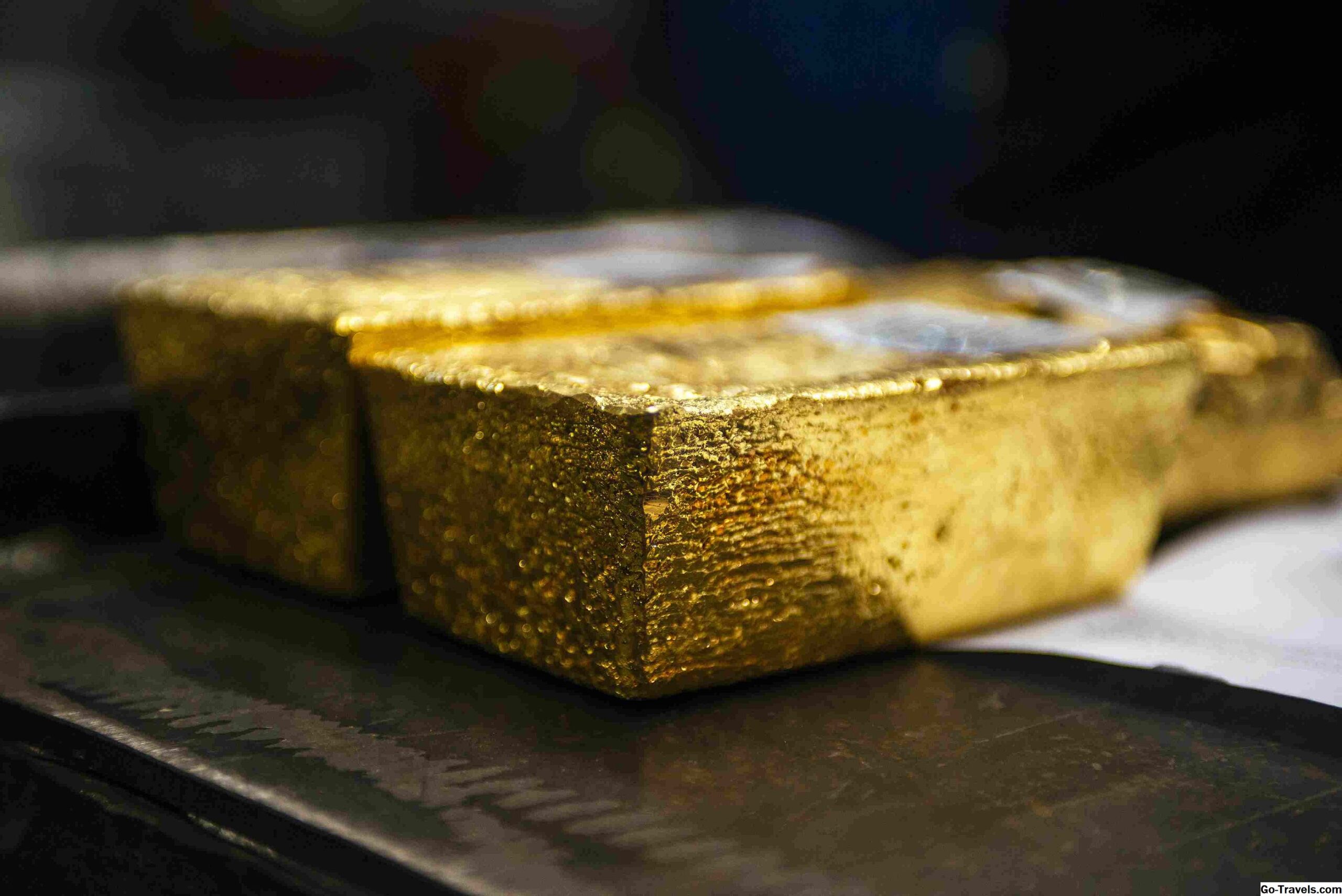

Gold charges have reached an unparalleled excessive of $2,449.89 in keeping with ounce on Monday, fueled by means of expectations of Federal Reserve fee cuts and escalating geopolitical tensions. Spot gold rose 0.4% to $2,424.30 in line with the ounce, whilst U.S. Gold futures accelerated 0.5% to $2,428.50 steady with the ounce. After the surge, traders booked income, causing gold to trim gains barely.

Key Drivers Behind Gold’s Record Surge

Federal Reserve Rate Cut Expectations

The number one catalyst for gold’s surge is the anticipation of U.S. Federal Reserve hobby rate cuts. Softer U.S. Inflation records for April, with the Consumer Price Index (CPI) developing by way of 0.3% in place of the anticipated 0.4%, has bolstered hopes for a price lessen in September. Lower hobby rates reduce the opportunity value of holding non-yielding bullion, therefore improving gold’s appeal.

Geopolitical Tensions

Rising geopolitical tensions are appreciably boosting gold’s secure-haven demand. The modern-day demise of Iranian President Ebrahim Raisi in a helicopter crash has intensified uncertainties inside the Middle East. Additionally, distinctive international conflicts and monetary uncertainties have contributed to this call for. Central banks, especially in BRICS worldwide locations, are growing their gold purchases, in addition to supporting gold fees.

Market Reactions and Federal Reserve Stance

Despite market optimism for rate cuts, Federal Reserve officers, which include Vice Chair Michael Barr, have emphasized a careful approach. They have indicated that more evidence of a sustained decrease in inflation is wanted earlier than easing monetary coverage. The Fed’s next meeting and upcoming inflation statistics may be essential in shaping destiny price alternatives.

Dollar and Treasury Yields

The U.S. Greenback dropped to a one-month low in opposition to most vital currencies, and Treasury yields fell, similarly enhancing gold’s splendor. The 10-one year Treasury yield dropped 8 foundation factors to 4.361%, and the 2-12 months yield slid nearly 7 foundation factors to 4.751%. A weaker greenback makes gold much less steeply-priced for holders of different currencies, whilst lower yields reduce the opportunity rate of retaining gold.

Outlook for Gold Prices

Gold expenses are possibly to live bullish inside the quick term, pushed via ongoing economic and geopolitical uncertainties. Market individuals are intently looking at upcoming economic data and Federal Reserve communications for further guidance on the timing and value of potential price cuts.

Key Points

Gold Prices: Rose to a file immoderate of $2,449.89 per ounce, supported with the aid of Fed price cut expectancies and geopolitical tensions.

Federal Reserve Rate Cut Expectations: Softer U.S. Inflation facts and hopes for a September fee lessen have boosted gold’s enchantment.

Geopolitical Tensions: Increased safe-haven call for because of conflicts and valuable bank purchases.

Market Reactions: Fed officials emphasize staying strong; upcoming meetings and data may be vital.

Dollar and Treasury Yields: Weaker dollar and lower yields enhance gold’s splendor.

Gold fees maintain to mirror market dynamics, driven by means of the use of a combination of monetary signs and symptoms and geopolitical activities. Investors need to live vigilant, staying informed at the brand new developments to navigate the gold market successfully.

Read More – Gold Prices: Riding the Wave of Optimism Despite Economic Uncertainty